AI-Ready Bank-in-a-Box for Banks and Cooperative Societies

A Modern Core Banking and ERP Solution for Financial Institutions

B-Banking is a comprehensive, modular solution engineered to meet the operational, compliance, and reporting needs of cooperative banks, district banks, and urban cooperative societies. It combines the capabilities of a modern ERP and a robust core banking system into a single, unified platform.

Designed to support agility and scale, it enables faster processing, real-time data access, and centralized control across functions and branches. Its AI-ready architecture ensures adaptability to future-ready innovations and compliance updates, while its customizable design allows institutions to align the system closely with their unique operational models.

Whether deployed on the cloud or on-premise, B-Banking simplifies digital transformation for financial institutions - supporting every core area, from daily transactions to regulatory audits.

Why Choose B-Banking?

One Platform. Complete Control.

Tailored for Sector-Specific Needs

Ready-to-use templates and workflows are optimized for cooperative institutions, NBFCs, RRBs, and state-level entities, accelerating implementation and reducing customization efforts.

Deployment on Your Terms

Available on both MEITY-empanelled cloud and on-premise environments, allowing institutions to maintain control over infrastructure and data governance.

Centralized Dashboards

Gain real-time visibility into key operations - NPA trends, loan disbursals, compliance status, and asset tracking—through role-based dashboards accessible across branch and head office levels.

Built to Scale

Designed for multi-branch institutions, B-Banking ensures consistent operations and regulatory compliance with centralized control and branch-wise autonomy.

Inclusive by Design

Deep support for AEPS, micro-ATM, biometric onboarding, and scheme integrations (PMJJBY, APY, PMFBY) enables financial access in rural and underserved areas.

Built For:

- Cooperative and District Banks

- Urban and Rural Cooperative Societies

- Multi-State Credit Societies

- Microfinance Institutions (MFIs)

- Non-Bank Financial Companies (NBFCs)

Whether your institution operates at the grassroots or spans multiple regions, B-Banking offers the flexibility, security, and compliance support needed to operate effectively in dynamic regulatory environments.

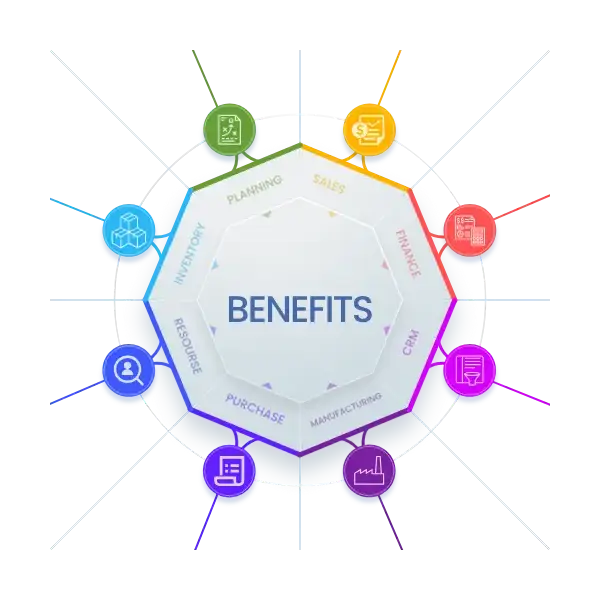

Benefits of B-DMS

Core Functional Modules

Advanced Capabilities

AI-powered forecasting: For loan risk, customer behavior, and credit segmentation

BI & Analytics: MIS reports, audit logs, and branch performance insights

API Gateway: RESTful APIs for CBS, GST, HRMS, PFMS, UPI, BBPS, and DMS integrations

Audit & GRC: Integrated governance, risk, and compliance tracking

Payments & Reconciliation: RTGS, NEFT, UPI, NACH, APBS with automated reconciliations

Compliance-Ready. Audit-Ready.

B-Banking reduces compliance burden by embedding key regulatory functions into its core

Automated GST, TDS, and income tax reporting

Built-in RBI and NABARD reporting formats

End-to-end audit trails across transactions

Integrated KYC during onboarding and document flows

Benefits

- Attendance Management

- Map Tracking

- Expense Management

- Complaints

- Payments

- Target Management

Explore the B-Banking Experience

A unified platform built to simplify banking, strengthen compliance, and bring intelligent, inclusive operations to every branch.